As the property market continues slow progress, the Government and Reserve Bank (RBNZ), content that there is more financial stability after restrictions, are making moves that will likely encourage more buyers into the market. This month’s HomesEstimate report shows that change could be afoot, with both Auckland and Wellington showing slight price increases compared with last month.

We explore the recent or impending changes to the loan-to-value ratio (LVR), the Credit Contracts and Consumer Finance Act (CCCFA), and the official cash rate (OCR), and what impacts they could have on the property market.

LVR

First introduced by RBNZ back in 2013 in response to the rapid growth in house prices, the LVR restrictions were designed to control the flow of new lending by limiting how much banks can lend against a mortgaged property.

The restrictions were removed entirely during the Covid times of 2020 and returned in March 2021, followed by further tightening when the market took off again in November 2021.

The RBNZ has announced that on 1 June 2023, these restrictions will again be eased: “We are proposing to ease our LVR settings reflecting the fact that current lending activity presents fewer risks to the financial system and household resilience compared to that of the past couple of years.”

The new setting will see:

- A 15% limit for loans with LVR above 80% for owner occupiers

- A 5% limit for loans with LVR above 65% for investors.

CCCFA

The CCCFA was introduced back in December 2021 and requires lenders to follow more stringent processes to ensure that lending is deemed responsible. The regulations, which put the brakes on the hot property market, had ‘unintended impacts’ and we’ve since seen the Government u-turn on many of the requirements.

Last week saw the last of a string of changes to the act, which essentially means that borrowers’ discretionary spending won’t be scrutinised as heavily, while still protecting the consumer.

OCR

The OCR is set by the Reserve Bank’s Monetary Policy Committee to help influence the country’s economic activity and inflation.

At the end of last month, inflation rates came in at 6.7 percent, lower than many were expecting and the lowest it’s been in over a year. This is a good sign that inflation is slowing and that we could be nearing the end of this series of OCR rises. If this is the case, it’s likely mortgage rates will soon peak, if they haven’t already. This will be welcome news for homeowners that are facing interest rate hikes and for new borrowers, as they can get a picture of worst-case rates.

The next OCR review is due to be released on 24 May.

Monthly Property Update

MAY 2023

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s May 2023 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

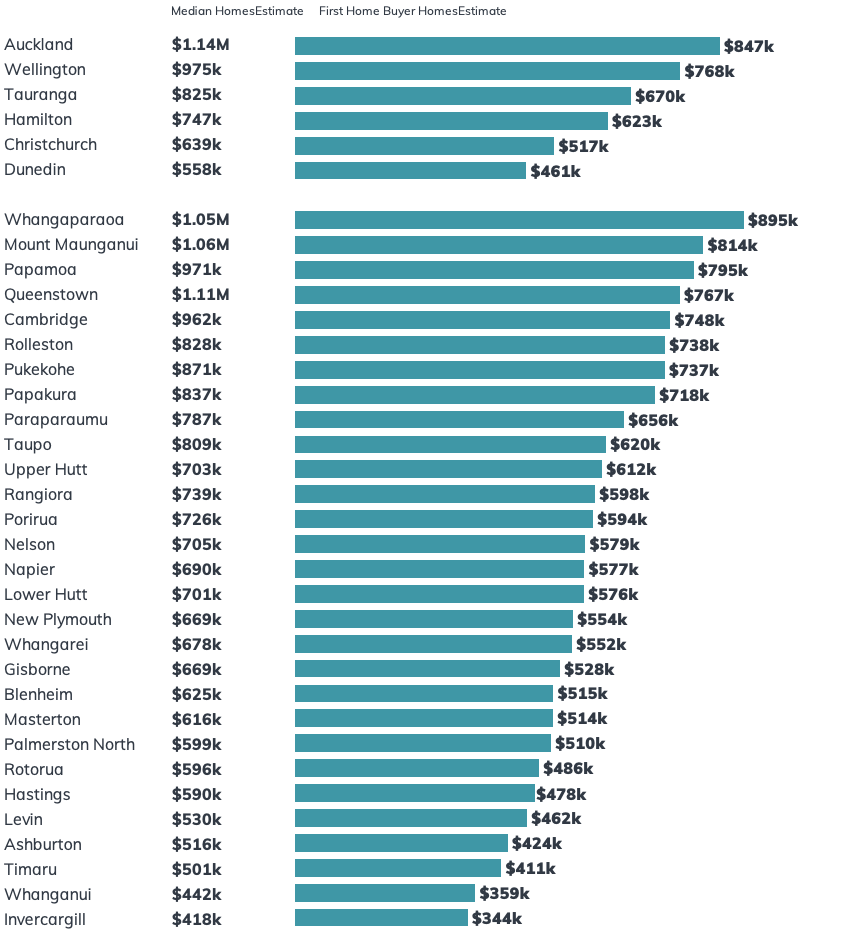

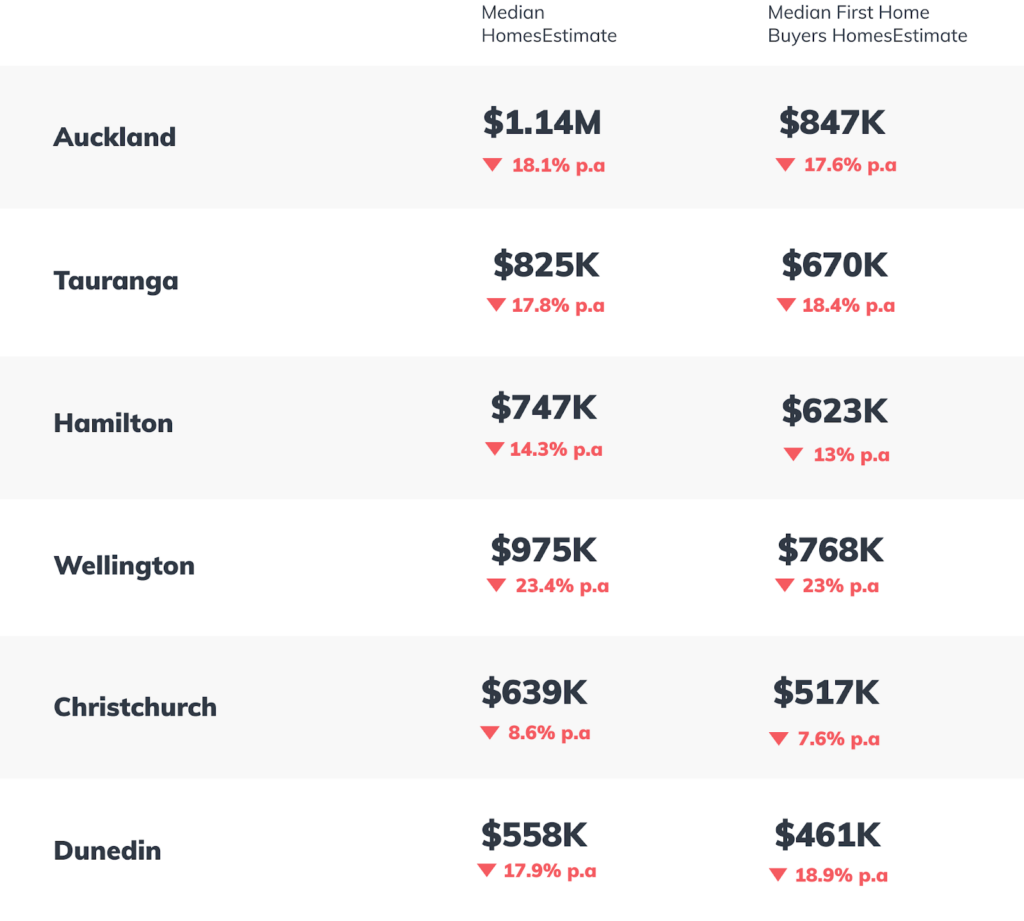

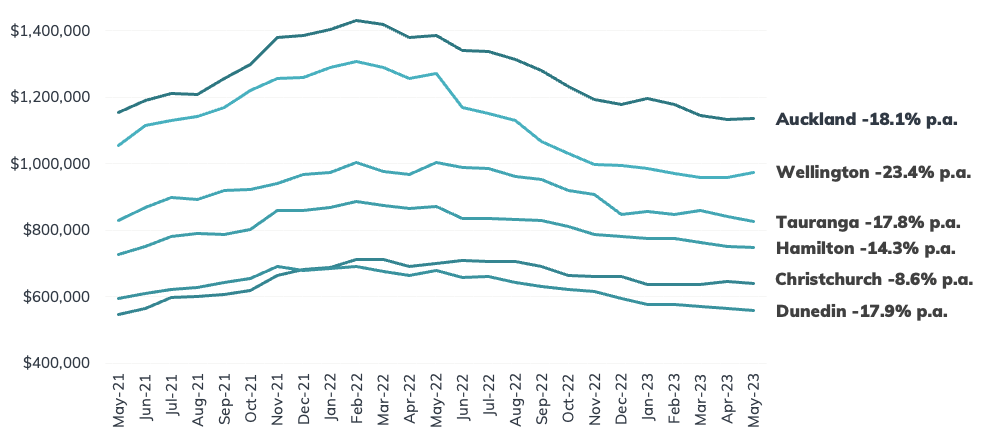

Trends in our Main Cities

Could the tide be changing? This month our median HomesEstimate shows a small increase for both Auckland (0.4 percent) and Wellington (1.9 percent) when compared to last month. Meanwhile, the rest of our main cities saw slight decreases.

We’ll be watching with bated breath to see if this trend continues next month.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s assessment of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.